Unreasonable at Sea day 43

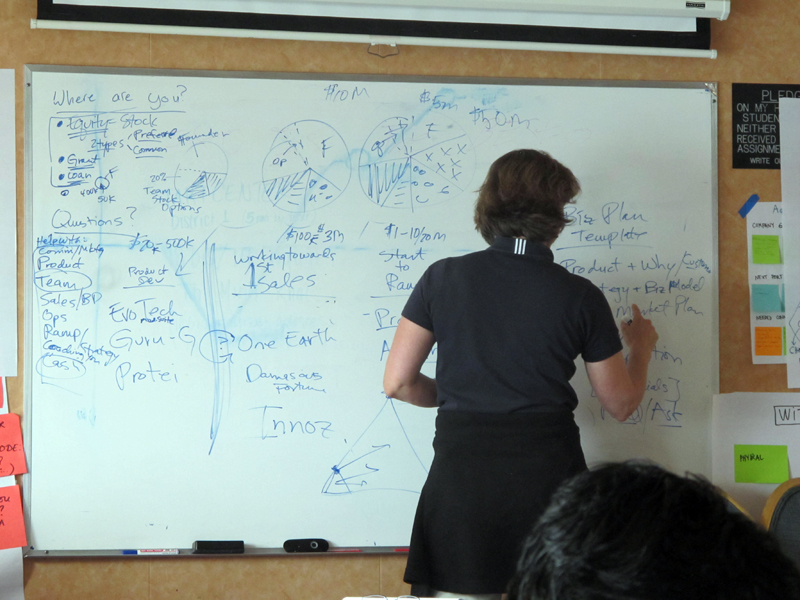

WORKSHOP 18; Tom Clayton (and Megan Smith) advice on Fund Raisng

This was a really cool session. Firstly, it was technical and from experience. So I learned a lot of new terms and details. He also went around the room and briefly found out where each company was in the scheme of things (fund-raising-wise). It was very good to hear some technical details about fundraising, along with some advice on what works / what doesn’t, as well as hear where each company was. The engagement heightens when we all go around the room briefly and address the real issues of each company individually.

Some notes:

99% of investors in the early stage want to invest within driving distance where they are located

You are competing against old established brands. When going to private institional investors and you mention social entrepreneurship, it usually means they will tone out. all they care about is returns, not doing good.

Laura’s question –>how do you talk credibly if your company doesn’t yet have numbers; so that you can tell a story and aren’t measured by the numbers

Grants: tax efficient grants are available in china and elsewhere, those are the types of startups attracted to singapore – clean bio / clean water

IN SINGAPORE:

-become a darling in singapore: get unlimited visas, import your talent; 19 companies from all over the world; best developers – from china philipines, cost of living is high but tax is SUPER low; 2% taxes; housing, schools and alcohol and cars;

-make less in terms of net income; But he said that prototyping costs are the same anywhere… huh? prototyping the same as anywhere?

Singapore is se asia hub for financing; sub 1 mil dollar; great for early stage companies

IN GENERAL:

–>you are never raising financing: i.e. play hard to get

–DONT say I NEED money – don’t say that you are in a strapped position

-being domicile in the us is important for us investors; early stage; ton of angel investors there

-dont do a joint venture – getting a sales and marketing partner, good

you have to do one in china to operate

DONT take any loans, which will be like a big anchor you are carrying – cause you have to service this debt

EQUITY means believeing in your vision

loan says: you are all alone

grant says: you’ve convinced me that i’m humanitarian and i should give you this money rather than school because you will affect more people that someone else

–how you capitalize becomes strategic – we need help because we are still figuring out our product – put money into THAT phase

–Even if you don’t get funding from the people you meet, definitely continue to send them a NEWSLETTER or something to keep up potential investors

How much you ask for: how much money do i actually need: what is the absolute, scrappiest; then ask for .3 more

Google made a mistake : They didn’t hire or build fast enough; They didn’t build data set fast enough; There was very well used money but it didn’t grow enough

–if you are deeply undercapitalized and starving, you don’t have margin. if you really think about scaling and impact you cannot be starving

meeting with Andrea from SAP on developing a business model

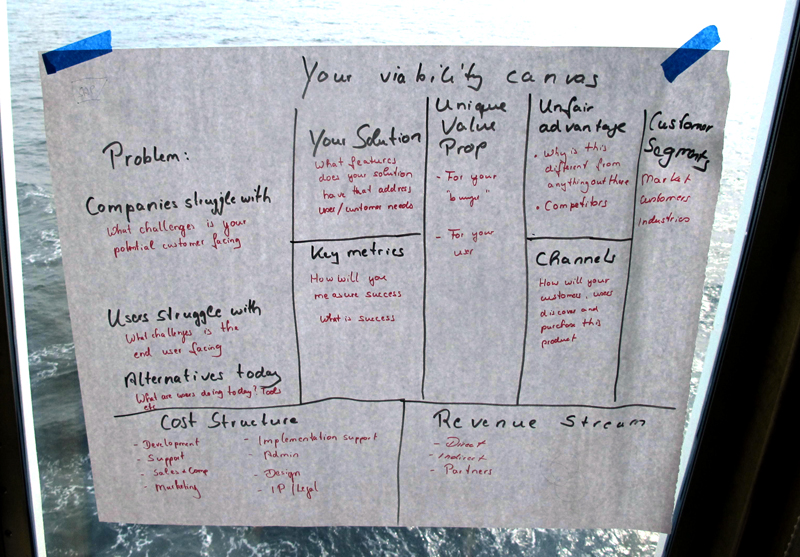

ON THE VIABILITY CANVAS:

how are you going to go to market, how are you going to sell it / pitch it

—who is the money giver and who is the end user

PROBLEMS:

-what is the unmet need; where does the big money come from

KEY METRICS – how will you evaluate success? What is your goal

–>unique value proposition; new technology and open source; cheap; THAT is our unfair advantage

CHANNELS – how are you going to get the message out, take to market? Much harder at the consumer level

–sell units; sell kits / accessories; sell data; consulting; contracts

call it something instead of hobbyists – design challenge – inventors; software / hardware innovators